Cash flow planning

Business planning, liquidity and cash flow calculation with SAP and Excel

What is cash flow planning?

Cash flow planning in the finance department is an important part of corporate planning and thus also of the planning process. This begins with cost center planning for the individual departments. This is followed by the P&L planning, in which the future expenses as well as income and thus the incoming and outgoing payments are analyzed. Based on the expected cash inflows and outflows of your company, you can now carry out cash flow planning in the next step and thus forecast future cash gaps and surpluses. The "end product" of this planning process is the budgeted balance sheet, which also forms the basis for the cash flow report. Cash flow planning therefore helps companies to derive potential financial risks or bottlenecks and identify them at an early stage so that planning adjustments can be made in good time. It makes a fundamental contribution to securing the existence of a company.

Challenges of cash flow planning

One difficulty in cash flow planning is to realistically map your company's payment targets. Different payment targets are defined with each supplier and for each expense, which naturally complicates cash flow planning considerably and requires complex calculations. The risk of formula errors in Excel is therefore immense.

To reproduce these complex events in a reduced way is one of the challenges in cash flow planning. Here, for example, DSO and DPO can be used, i.e. Days Sales Outstanding and Days Payable Outstanding. The DSO metric tells you how many days it takes for an expense to become a payment. If you have a DSO of 30 days, then it means waiting an average of 30 days for that revenue to actually hit your company's bank account. DPO is about what the average payment term is for your expenses. So, if you deposit 40 days payment term, it means for every expense you purchased, you pay on average after 40 days. This can also be the case the other way around, if you take advantage of cash discounts, for example. Then the DSO would probably be closer to 10 days, as it depends on the payment term agreed with the supplier.

Another challenge is that very many detailed plans or even additional investment plans have to be combined in the cash flow planning. This often leads to transfer errors to Excel and a very complex planning table. In connection with cash flow planning, sales tax must also usually be taken into account in the individual detailed plans, which often leads to planning errors.

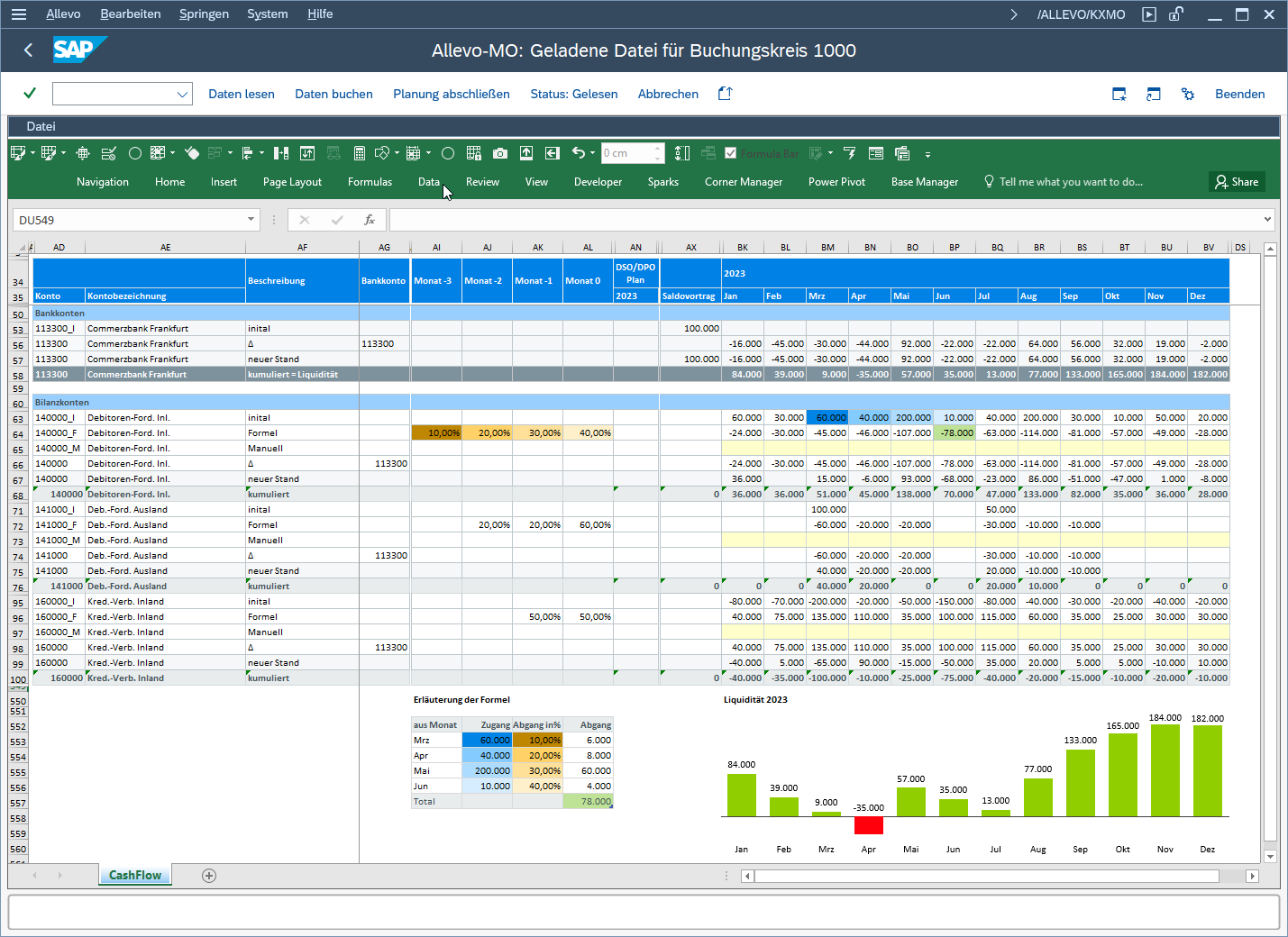

Allevo - Efficient cash flow planning with Excel in SAP

Our Allevo planning tool helps you to implement your cash flow planning more easily and quickly in the future. This is because, thanks to the Excel-SAP integration, you can map different specialist planning centrally in your SAP system and, at the same time, access your specialist and cost center planning using an Excel user interface in order to process it further for cash flow planning. Thanks to Allevo Balance's Cash Manager, you can intervene manually at any time and make changes, such as to DSO values, even after planning. This makes it very easy to implement small adjustments at short notice.

Allevo offers you another benefit in connection with VAT calculation. Since the expenses you plan on a cost center are net, sales tax must also be taken into account in connection with cash flow calculation and cash flow planning, which presents an additional challenge. Thanks to Allevo, you can also automatically calculate the corresponding sales tax during expense planning and thus take it into account for the cash flow calculation via Cash Manager.

Get a live demo for free

You would like to get to know our software solutions without obligation and free of charge? Then get to know it in a live online demo. Our specialists will answer your individual questions and provide insights into our SAP Excel integration.

The benefits of cash flow planning with Allevo

-

Excel user interface and SAP system for data management

-

Access to departmental and cost center planning in SAP

-

Automatic sales tax and cash flow calculation

-

Manual planning adjustments in the Excel frontend

-

Posting of data in SAP at the push of a button

-

No external software or hardware

Allevo at Energie Wasser Bern

"The most important thing for me is the integration of Allevo in SAP, where we can use current master and transaction data from SAP. This makes it possible to write the plan data in SAP without media breaks." – Stephan Mücher, Controlling Manager

More References